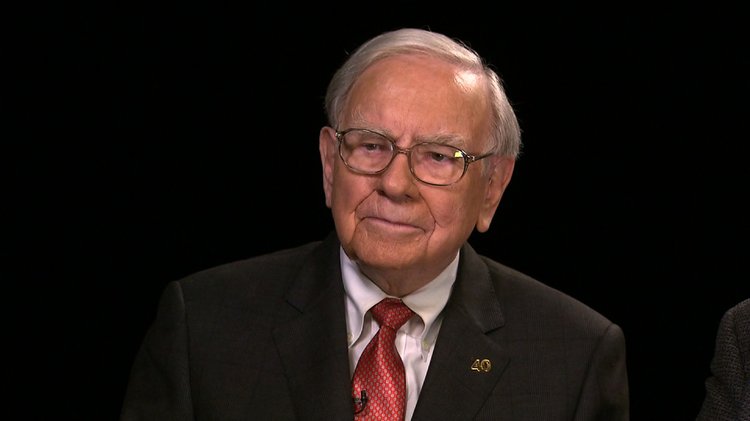

Warren Buffett Says Early-Career Salary Doesn’t Matter Much—Here’s What You Should Focus On Instead

As Warren Buffett prepares to step down as CEO of Berkshire Hathaway at the end of 2024, the legendary investor used this year’s annual shareholder meeting to reflect on the lessons that shaped his remarkable career. Since taking over Berkshire in 1965, Buffett has transformed the once-struggling textile company into a trillion-dollar conglomerate. With a personal net worth estimated at $160 billion, his insights into success continue to draw attention from investors of all ages.

During the meeting, an attendee asked Buffett about the most pivotal lessons he learned early in his career. His answer had nothing to do with money, titles, or rapid advancement. Instead, he emphasized the power of choosing the right people to work with.

“Who you associate with is enormously important,” Buffett said. “You are going to have your life progress in the general direction of the people that you work with, that you admire, that become your friends.”

Buffett cautioned young professionals against focusing too heavily on how much they’re paid at the start of their careers. Instead, he urged them to be intentional about their environment and their mentors.

“Don’t worry too much about starting salaries and be very careful who you work for, because you will take on the habits of the people around you,” he explained. “There are certain jobs you shouldn’t take.”

The key, he said, is to find work you genuinely enjoy and to surround yourself with people you respect and can learn from. While following in the footsteps of a successful figure might seem appealing, Buffett believes lasting success comes from discovering your own passions and connecting with people who challenge and inspire you.

“I’ve had five bosses in life and I liked every one of them — they were all interesting,” he said. “I still decided that I’d rather work for myself than anybody else. But if you find people that are wonderful to work with, that’s the place to go.”

Buffett also warned against the temptation to chase short-term wins or get swept up in risky trends that promise fast profits. He encouraged young people to look for meaningful work and stay grounded in principle, even if that path seems slower or less flashy.

“If very stupid things are happening around you, you do not want to participate,” he said. “If people are making more money because they’re borrowing money or participating in securities that are pieces of junk … you have to forget that. That’ll bite you at some point.”

Known for his long-term investment philosophy, Buffett has consistently promoted patience, discipline, and rational thinking. He famously wrote in 1996, “If you aren’t willing to own a stock for 10 years, don’t even think about owning it for 10 minutes.”

He has long warned against trying to time the market or jumping into speculative assets like cryptocurrency. Instead, he believes in building a solid, diversified portfolio and sticking to a simple, well-reasoned plan.

In a 2018 letter to shareholders, Buffett summarized his approach to investing: “The key qualities you need are the ability to disregard mob fears or enthusiasms and to focus on a few simple fundamentals.”

For Buffett, those same fundamentals apply not only to investing, but to building a career: focus on substance over hype, learn from people you admire, and let values—not paychecks—guide your decisions early on. Over time, the rewards will follow.